Oscillators Explained

Oscillators are a group of indicators that confine the theoretically infinite range of the price action into more practical limits.They were developed due to the difficulty of identifying a high or low value in the course of trading .Although we may have mental concepts of what is high or low in a typical day's price action, the volatile and chaotic nature of trading means that any high can easily be superseded by another one that sometimes follows on the heels of a previous record, and negates it swiftly. In short, practice and experience tell us that prices in themselves are very poor guides on what constitutes an extreme value in the market, and. oscillators aim to solve this problem by identifying indicator levels that hint at tops or bottoms, and helping us in the decision process .

Why should use I oscillators?

There are two ways of using an oscillator. One is to determine turning points, tops and bottoms, and this style is usually useful while trading ranges only. Oscillators are also used trending markets, but in this case our only purpose is joining the trend. Highs or lows, tops or bottoms are used for entering a trade in the direction of the main trend.- MACD

- RSI

- Williams Oscillator

- Commodity Channel Index

Moving Averages Explained

Moving Averages are technical tools designed to measure the momentum and direction of a trend. The idea behind their creation is simple. Price action is thought to fluctuate around the average value over a period of time ,and we can expect to be able to the represent the market's momentum by calculating if the current prices are above or below the market's average value. But since the total length of the time period that must be included in the calculation of the average is too large (are we going to begin in 1980, or the year 2000 while computing our time series?), we pick the period arbitrarily, and update the average as time progresses.

Why Should I Use Moving Averages?

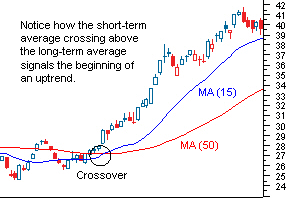

Moving averages are some of the most useful and effective gauges of market action in a trending market. Crossovers, divergences, as well as trends of the moving average itself can be used to analyze and crystallize the signals that can be distilled from the market action, which can then be used to help us make future decisions about our trades.Types of Moving Averages

- Simple Moving Average

- Exponential Moving Average

- Smoothed Moving Averaged

- Linear Regressed Moving Average

Momentum Indicators Explained

What is momentum? The term has a specific meaning in physics, and perhaps it is easier to understand the momentum of prices by considering an analogy. We know that the speed of a swinging pendulumwill vary along the vertical axis, for example, as the pendulum moves from the bottom to the uppermost extent of its oscillation. Although the vertical movement of the pendulum is zero at the top of its range (since otherwise it would fly away), the forces acting on it at the same point is maximum. Conversely, as the pendulum reaches its maximum speed, the forces generating the speed are at their minimum. The oscillation of force and speed that creates the observed back and forth movement in the pendulum is very similar to the oscillation of prices in the market.

How to use Momentum Indicators

There is of course no rock-solid rule about the use of this type of indicator. A capable trader can create profitable trades even with a most unlikely combination of indicators. On the other hand, there are some common rules that would help many newcomers by restricting them to a less volatile, less emotional course of action. This section is mostly aimed at supplying such a set of rules.Types of Momentum Indicators

- Oscillators

- Momentum Indicator

- Rate of Change

There are few markets that require the level of privacy, honesty, and trust between its participants as the FX market. This creates great obstacles for traders, investors, and institutions to overcome as there is a lack of transparency. With little to no transparency trader’s ability to verify transactions becomes virtually impossible. Without transparency there is no trust between the client and the broker.

Our Clients (hereinafter known as "THE CLIENT" or simply You) are the most important part of our business, and we work tirelessly to ensure your complete satisfaction. Protecting the privacy and safeguarding the personal and financial information of our clients and website visitors is one of our highest priorities

This privacy policy sets out how OTL Trading uses and protects any information that you give OTL Trading when you use this website.

OTL Trading is committed to ensuring that your privacy is protected. Should we ask you to provide certain information by which you can be identified when using this website, then you can be assured that it will only be used in accordance with this privacy statement.

All client's funds deposited with OTL Trading are fully segregated from the company’s funds and are kept in separate accounts. This ensures that those funds belonging to clients cannot be used for any other purpose. We maintain sufficient liquid capital to cover all client deposits, potential fluctuations in the company’s currency positions and outstanding expenses. We use rigorous firewalls and Secure Sockets Layer (SSL) software to protect information during transmission. All deposited funds are safely kept on a separated account with the purpose of ensuring the protection of a client money.

OTL Trading uses an automated transaction monitoring and risk-management system to ensure that a client's balance will never fall below the level of their initial deposits, protecting them from any losses beyond their original investment at OTL Trading’s cost.

Risk Disclaimer:- Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor, legal advisor, friends and close family members if you have any doubts