Introduction to Candlesticks

The Japanese began using technical analysis to trade rice in the 17th century. While this early version of technical analysis was different from the US version initiated by Charles Dow around 1900, many of the guiding principles were very similar:- The “what” (price action) is more important than the “why” (news, earnings, and so on).

- All known information is reflected in the price.

- Buyers and sellers move markets based on expectations and emotions (fear and greed).

- Markets fluctuate.

- The actual price may not reflect the underlying value.

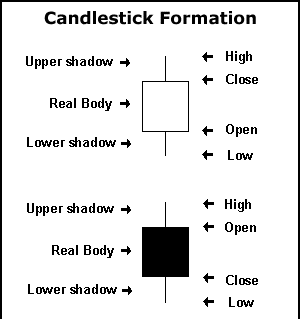

Formation

In order to create a candlestick chart, you must have a data set that contains open, high, low and closevalues for each time period you want to display. The hollow or filled portion of the candlestick is called “the body” (also referred to as “the real body”). The long thin lines above and below the body represent the high/low range and are called “shadows” (also referred to as “wicks” and “tails”). The high is marked by the top of the upper shadow and the low by the bottom of the lower shadow. If the stock closes higher than its opening price, a hollow candlestick is drawn with the bottom of the body representing the opening price and the top of the body representing the closing price. If the stock closes lower than its opening price, a filled candlestick is drawn with the top of the body representing the opening price and the bottom of the body representing the closing price.

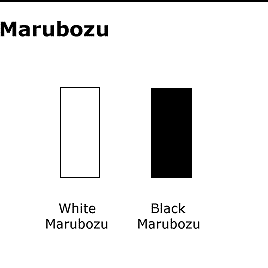

Long white candlesticks show strong buying pressure. The longer the white candlestick is, the further the close is above the open. This indicates that prices advanced significantly from open to close and buyers were aggressive. While long white candlesticks are generally bullish, much depends on their position within the broader technical picture. After extended declines, long white candlesticks can mark a potential turning point or support level. If buying gets too aggressive after a long advance, it can lead to excessive bullishness. Long black candlesticks show strong selling pressure. The longer the black candlestick is, the further the close is below the open. This indicates that prices declined significantly from the open and sellers were aggressive. After a long advance, a long black candlestick can foreshadow a turning point or mark a futureresistance level. After a long decline a long black candlestick can indicate panic or capitulation.

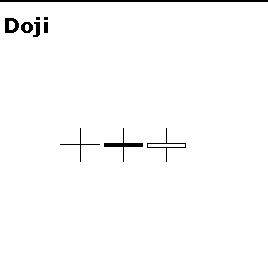

Doji

Doji are important candlesticks that provide information on their own and as components of in a number of important patterns. Doji form when a security's open and close are virtually equal. The length of the upper and lower shadows can vary and the resulting candlestick looks like a cross, inverted cross or plus sign. Alone, doji are neutral patterns. Any bullish or bearish bias is based on preceding price action and future confirmation. The word “Doji” refers to both the singular and plural form.

Bulls Versus Bears

A candlestick depicts the battle between Bulls (buyers) and Bears (sellers) over a given period of time. An analogy to this battle can be made between two football teams, which we can also call the Bulls and the Bears. The bottom (intra-session low) of the candlestick represents a touchdown for the Bears and the top (intra-session high) a touchdown for the Bulls. The closer the close is to the high, the closer the Bulls are to a touchdown. The closer the close is to the low, the closer the Bears are to a touchdown. While there are many variations, I have narrowed the field to 6 types of games (or candlesticks)

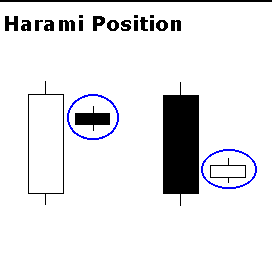

Harami Position

A candlestick that forms within the real body of the previous candlestick is in Harami position. Harami means pregnant in Japanese and the second candlestick is nestled inside the first. The first candlestick usually has a large real body and the second a smaller real body than the first. The shadows (high/low) of the second candlestick do not have to be contained within the first, though it's preferable if they are. Doji and spinning tops have small real bodies, and can form in the harami position as well. Later we will examine candlestick patterns that utilize the harami position.

Hammer and Hanging Man

The Hammer and Hanging Man look exactly alike, but have different implications based on the preceding price action. Both have small real bodies (black or white), long lower shadows and short or non-existent upper shadows. As with most single and double candlestick formations, the Hammer and Hanging Man require confirmation before action.The Hammer is a bullish reversal pattern that forms after a decline. In addition to a potential trend reversal, hammers can mark bottoms or support levels. After a decline, hammers signal a bullish revival. The low of the long lower shadow implies that sellers drove prices lower during the session. However, the strong finish indicates that buyers regained their footing to end the session on a strong note. While this may seem enough to act on, hammers require further bullish confirmation. The low of the hammer shows that plenty of sellers remain. Further buying pressure, and preferably on expanding volume, is needed before acting. Such confirmation could come from a gap up or long white candlestick. Hammers are similar to selling climaxes, and heavy volume can serve to reinforce the validity of the reversal.

Further Study

There are so many studies in candle sticks if you want to learn more about you can go to book store ....There are few markets that require the level of privacy, honesty, and trust between its participants as the FX market. This creates great obstacles for traders, investors, and institutions to overcome as there is a lack of transparency. With little to no transparency trader’s ability to verify transactions becomes virtually impossible. Without transparency there is no trust between the client and the broker.

Our Clients (hereinafter known as "THE CLIENT" or simply You) are the most important part of our business, and we work tirelessly to ensure your complete satisfaction. Protecting the privacy and safeguarding the personal and financial information of our clients and website visitors is one of our highest priorities

This privacy policy sets out how OTL Trading uses and protects any information that you give OTL Trading when you use this website.

OTL Trading is committed to ensuring that your privacy is protected. Should we ask you to provide certain information by which you can be identified when using this website, then you can be assured that it will only be used in accordance with this privacy statement.

All client's funds deposited with OTL Trading are fully segregated from the company’s funds and are kept in separate accounts. This ensures that those funds belonging to clients cannot be used for any other purpose. We maintain sufficient liquid capital to cover all client deposits, potential fluctuations in the company’s currency positions and outstanding expenses. We use rigorous firewalls and Secure Sockets Layer (SSL) software to protect information during transmission. All deposited funds are safely kept on a separated account with the purpose of ensuring the protection of a client money.

OTL Trading uses an automated transaction monitoring and risk-management system to ensure that a client's balance will never fall below the level of their initial deposits, protecting them from any losses beyond their original investment at OTL Trading’s cost.

Risk Disclaimer:- Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor, legal advisor, friends and close family members if you have any doubts